Gobbill CEO speaking at FinCrime Conference: Impact of NDIS legislation changes on billions in fraud.

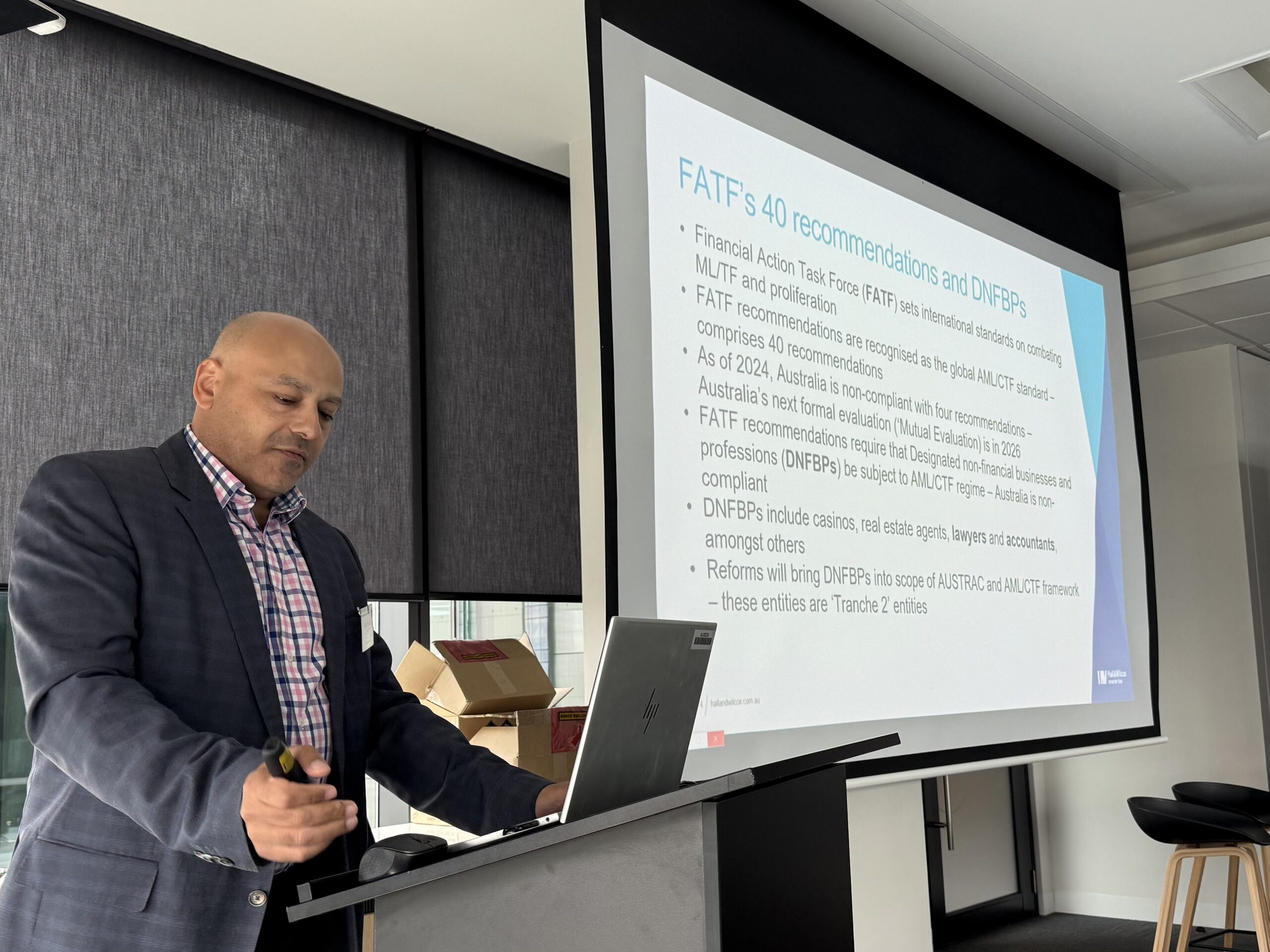

November 20, 2024AUSTRAC has published draft rules that will align Anti-Money Laundering and Counter-Terrorism Financing rules with the new AML/CTF laws. Speakers John Bassilios and Aaron Soh covered what changes are coming, what business owners needed to do and by when. They provided a specialist legal perspective and hands on experience perspective, helping SMEs comply with AML/CTF laws.

Speaker John Bassilios

Partner & Fintech and Blockchain Lead Hall & Wilcox john.bassilios@hallandwilcox.com.au

John has broad experience in financial services, funds management, blockchain, corporate and commercial law, with a particular emphasis on funds management related matters. John is one of Australia's leading Fintech and Blockchain/crypto lawyers and is a Director on the board of the Digital Economy Council of Australia. John is the FinTech & Blockchain Lead at Hall & Wilcox. He has acted for a wide range of financial services providers (both start-ups and established industry providers), including retail and wholesale fund managers, investment advisers, financial planners, stockbrokers, IDPS operators, managed discretionary account providers and consumer credit providers. He has advised financial services providers on all aspects of managed investments schemes, AFSL and ACL licensing, disclosure requirements, and ongoing compliance with regulatory requirements including AML/CTF. John also has extensive experience in advising financial services industry participants in relation to the establishment and development of various financial products, as well as the preparation of disclosure documents such as financial services guides, product disclosure statements and information memoranda. John also has significant experience in a broad range general corporate commercial matters; from company establishment, shareholder agreements, mergers and acquisition and ASX listings. More recently John has taken a keen interest in blockchain/crypto related matters and gained significant experience advising on, and establishing, crypto currency funds, reviewing Whitepapers for Initial Coin Offerings (ICO) and token sales and advising on the establishment of cryptocurrency exchanges including preparing AML/CTF Programs and terms of use and advising on conducting Security Token Offerings (STOs) in Australia.

Aaron Soh

Managing Director Testudo Compliance Group aaron.soh@testudocompliance.com

Aaron is an experienced risk and compliance specialist who is currently working with global ASX and NASDAQ listed institutions as well as small-medium sized businesses to meet their regulatory compliance obligations. Currently, Aaron serves as a Responsible Manager on Australian Financial Services Licences, and is a compliance advisor to both small and large organisations. He has assisted clients to create and implement practical compliance solutions that has improved their business outcomes rather than just being obstacles. Previous to Testudo Compliance Group, Aaron founded and managed a Compliance Department for an ASX-listed FinTech. As the Global Head of Compliance and AML/CTF Compliance Officer, Aaron led teams of lawyers and AML/CTF professionals in designing, implementing, and managing the compliance regimes of various financial services, payment products and FinTech solutions worldwide.

A great resource is the Hall & Wilcox article written by John Bassilios

New AML/CTF rules released: what you need to know

To find out more, contact gobbill@gobbill.com.au or visit gobbill.com