6 New Financial Year Resolutions to Save you Time and Money

July 17th, 2017 Posted by Gobbill Business Management, Financial Management 0 thoughts on “6 New Financial Year Resolutions to Save you Time and Money”The new financial year is always a great excuse to implement some money-saving strategies and get the ball rolling for the year ahead. Here are six tips to help you get started:

Set Up a Savings Plan

Budgeting doesn’t have to be complicated. Simply review your spending: What areas of your spending are unnecessary and what things can’t you live without? Whether your priority is a new car or a daily coffee, encourage good habits with your spending. Make a budget that you understand and is realistic for you to follow.

Shift Money to Repay Debt

There’s no avoiding some form of debt these days. Set yourself a timeframe and add repayment of debt to your budget. Credit card debt in particular has the potential to incur high interest and fees on top of your debt, which will extend the amount of time required to pay it off. There’s nothing more relieving than removing the debt cloud over your head. If possible, shift any spare cash from savings and transactional accounts to reduce outstanding loans.

Take Out Private Health Insurance

Individuals and families on incomes above the Medicare levy surcharge (MLS) thresholds are liable to pay a surcharge for any period during the year that they do not have a private patient hospital cover. To avoid this extra cost, seek private health insurance with an approved health care fund for the next financial year.

Salary Sacrificing

Seek financial advice to identify the potential benefits of reducing taxable income, by allocating a certain amount of your pre-tax salary to be paid directly into your superfund. This financial year, you can put up to $25, 000 (for under 50s) of your pre-tax earnings into super under a concessional tax rate.

Keep Track of your Tax Deductions

Keep yourself organised and avoid the last minute paperwork by keeping track of your tax deductions. If you have expenses that can be paid before the end of the financial year, pre-pay these and reduce your tax total.

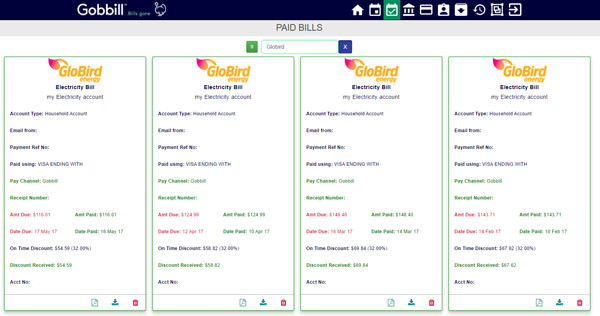

Join Gobbill and Save Time

An increasing number of people are working from home. If you work from a home office, then you have the potential to claim tax deductions on your home utility bills, landline and mobile phone bills, home and mortgage insurance, as well as internet. Rather than making home business payments manually, sign up to Gobbill and automate your payment process. Bill payment information can be easily exported for tax time, just with an easy click of a button.