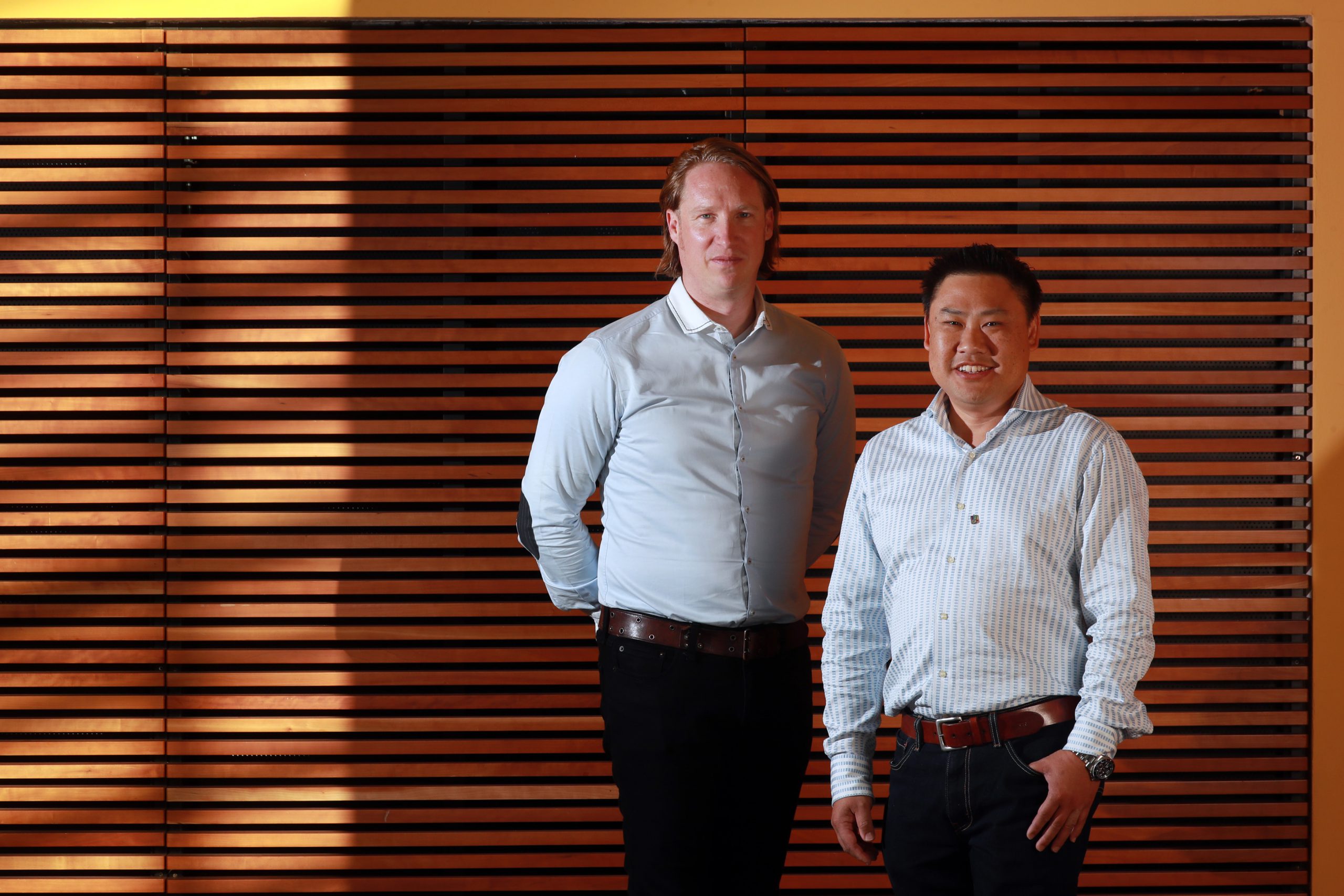

Fake invoices caused $8.7m hit and collapse of Sydney hedge fund.

November 23rd, 2020 Posted by Gobbill Uncategorized 0 thoughts on “Fake invoices caused $8.7m hit and collapse of Sydney hedge fund.”A Sydney hedge fund has collapsed after a cyber attack triggered by a fake Zoom invitation saw its trustee and administrator mistakenly approve $8.7 million in fraudulent invoices.

NSW police are investigating the matter as digital crime experts report a spike in attacks on hedge funds and private equity firms this year, as informal checks were weakened due to staff working at home as a result of the pandemic.

The Australian Financial Review has been told of another fund which lost $25 million in client money from a similar cyber attack, while the trustee for another firm blocked a $1.8 million transfer after the fake invoice was spotted.

Read more at The Australian Financial Review