Scammers use phishing attacks to ‘socially engineer’ their way into your savings.

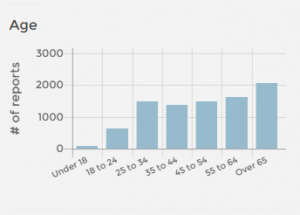

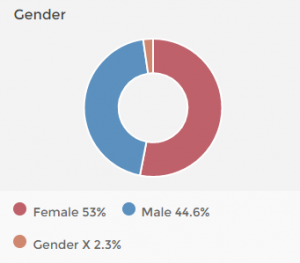

August 21st, 2023 Posted by Gobbill Fraud Prevention, Internet Safety, Staysmartonline 0 thoughts on “Scammers use phishing attacks to ‘socially engineer’ their way into your savings.”The latest figures reveal phishing is a practice that is only becoming more and more widespread. Phishing was the most reported scam to Scamwatch in 2022, with the government website recording 74,573 complaints — a 4.6 per cent increase on the previous year. In 2022, the total financial losses from phishing reported to Scamwatch and the Australian Financial Crimes Exchange totalled $157.6 million.

Advances in machine learning and AI have made it harder to detect phishing scams.

The success of a phishing scam hinges on manipulating the emotions and behaviours of a potential victim.

Urgent calls to action requiring a victim to pay off an outstanding tax debt or reactivate a suspended bank account are common techniques used by scammers. Ofir Turel, professor of information systems management at the University of Melbourne, says scammers appeal to the impulsive part of our brains, using temptation to override restrained, logical thinking.

Read more..