Money Series: All you need to know about budgeting.

February 22nd, 2021 Posted by Gobbill Financial Management 0 thoughts on “Money Series: All you need to know about budgeting.”A budget is the best tool you have to help you work out where your money is going, to create a plan to help you think about your finances in the longer-term, and to feel more in control of your money. Don’t be nervous! You don’t need any special tools or expertise to set up your own budget. You just need the will to start looking at where you are right now and where you want to be.

PLANNING

Set your money goals

First, work out why you want to do a budget. This can help you to decide where you want your money to go. Ask yourself: What is my goal? It could be to stay on top of bills, free yourself from debt, save for emergencies, pay for your children’s education, or save for a holiday or a house deposit. Set a savings goal and work out how much you can save each payday. The Australian Government website, MoneySmart, offers a free savings goal calculator to help you work out how long it will take you to reach this goal. You can then put aside money for big bills when they arrive, and plan savings to achieve your money goal.

TRACKING

Tracking your spending is a way to take control of your money. If you ‘don’t see it, you don’t know’. Knowing exactly how much is coming in and going out can help you spend less and save more. Having a clear picture of your regular expenses and spending habits will help you set up your budget.

- Understand where your money goes. Taking the time to make a note of every dollar you spend can give you a clear view of where your money is going. You may be surprised by how much all those small things add up. You might also discover hidden costs, like account fees, subscriptions you don’t use, or mistaken transactions (If you discover these, consult the MoneySmart website advice on how to resolve this). Just knowing where your money goes may be all you need to start spending less. You may even start saving more.

- Track your spending and expenses

- How to track your spending. Start small by recording your spending every day for at least a week. This way you can see all the money going out. If you have some weeks or months with more expenses, then track over two weeks or two months. This will give you a more accurate picture. Don’t worry about changing your spending habits straight away. Just track day by day. It might be easier to track with your partner, parent or a friend: You can encourage each other and stay on track.

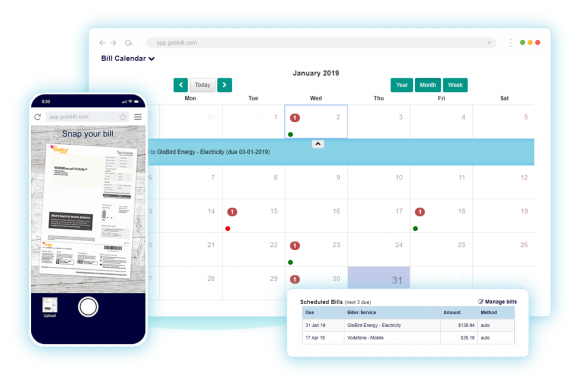

- Use a phone app. A phone app is an easy way to track your spending at the time you spend.

- Some apps offer more options, such as setting spending limits and reminders, and seeing your expenses at a glance.

- Look at your statements and receipts. When you use a debit or credit card, every transaction is recorded for you.

- You can view or download these transactions using online banking, or look at your hard-copy statements or receipts.

- Write it down. Write down every dollar you spend. Include the amount, item or store name, and date. You should do this for both cash and card purchases. Do this as you spend, or set a reminder to do it once a day, using your receipts.

- See how you’re tracking. At the end of your tracking period, look at your recorded transactions to see where your money is going. You might find that just by being aware of your spending you start to spend less. Take a moment to ask yourself: Do I need this? Would it be cheaper somewhere else? This can help you think twice about buying something.

- See where you can save. A good first step is to look at any small items that add up over time. Try cutting back on small, frequent expenses, such as takeaway coffee or lunch. This is a great way to start a savings habit. MoneySmart has some great ideas on simple ways to save money. You could also see whether you could redirect this money, maybe to a savings account, an emergency fund, or to your mortgage.

- Separate needs from wants. Look at all your transactions and highlight what are ‘needs’ — essential items you need to live. This will give you a clear picture of what are ‘wants’. These are the things you could cut back on or live without to save money.

- Set limits and reminders. Seeing how much you spend on certain things can help you set a realistic limit for the next week or month. This can help you avoid overspending. Knowing when regular expenses are going to pop up means that you can set reminders and put aside money to cover these payments.

- Do a budget. Knowing where your money is going day to day is great first step to creating a budget. The next step is to see where it’s going over a month, then a year. Having a budget can help you feel in control of your money, prepare for big expenses, and save.

SETTING UP YOUR BUDGET

Easy steps to manage and categorise how you spend your money. Use how often you get paid as the timeframe for your budget. For example, if you get paid weekly, you can set up a weekly budget. Then follow these steps to set up each section.

- Record your income. Record how much money is coming in and when. If you don’t have a regular amount of income, work out an average amount. Make a list of all money coming in, including:

- how much

- where from

- how often (weekly, fortnightly, monthly or yearly)

This money could be from your wages, pension, government benefit or payment, or income from investments.

- Add up your expenses. Record your regular expenses, including:

- what for

- how much

- when

Regular expenses are your ‘needs’ — the essential items you need to pay for to live. These include:

| Fixed expenses, for example:rent or mortgage paymentselectricity, gas and phone billscouncil rateshousehold expenses, like food and groceriesmedical costs and insurancetransport costs, like car registration and public transportfamily costs, like baby products, child care, school fees and sporting activities |

| Debt expenses, for example:personal loan repaymentscredit card paymentsmortgage repayments |

| Unexpected expenses, for example:car repairs and servicesmedical billsextra school costspet costs |

To make sure you’ve recorded all your expenses, look at your bills or bank statements. If you tracked your spending using the MoneySmart tool, use your list of transactions.

- Check if you can save. Having some savings can help create a safety net for unexpected expenses. Set a savings goal and work out how much you can save each payday. You can use the MoneySmart savings goal calculator to work out how long it will take you to reach your savings goal.

- Set your spending limit. The money you have left after expenses and savings is your spending money. This money is for ‘wants’, such as entertainment, eating out and hobbies. Make a plan for what you want to do with your spending money. This will help you to keep within your limit. Be sure to keep track of your spending so you always know how much you’ve got left.

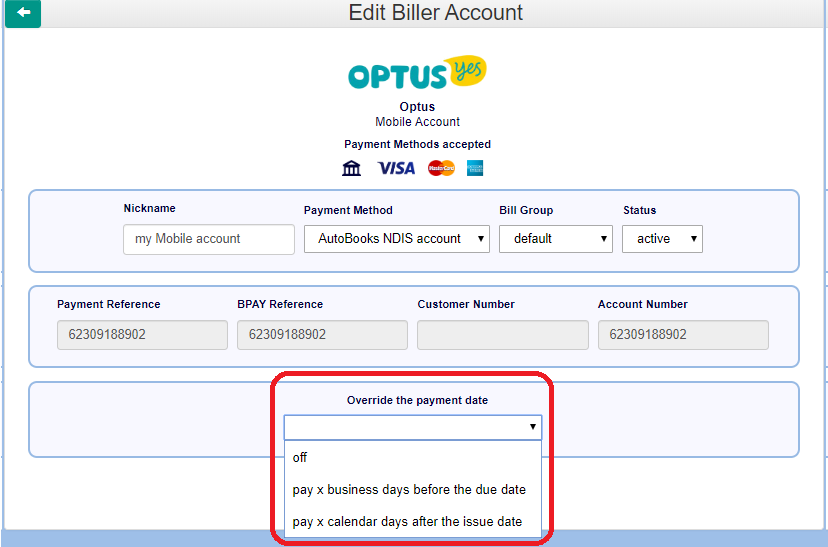

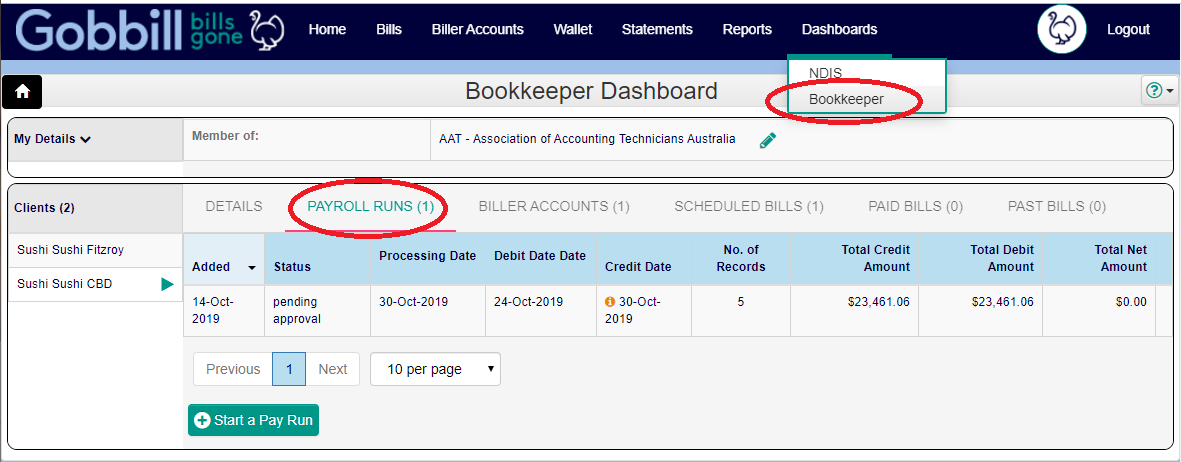

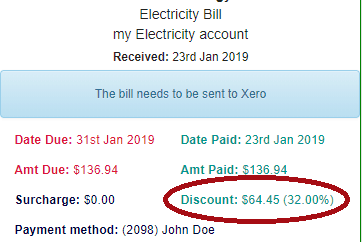

- Bank Accounts. You can set up three bank accounts: A high interest savings account for savings, and two transaction accounts, one each for spending and bills. It’s good to schedule automatic transfers for as soon as you receive your wages to your savings, and explore using a tool such as Gobbill to automate your finances.

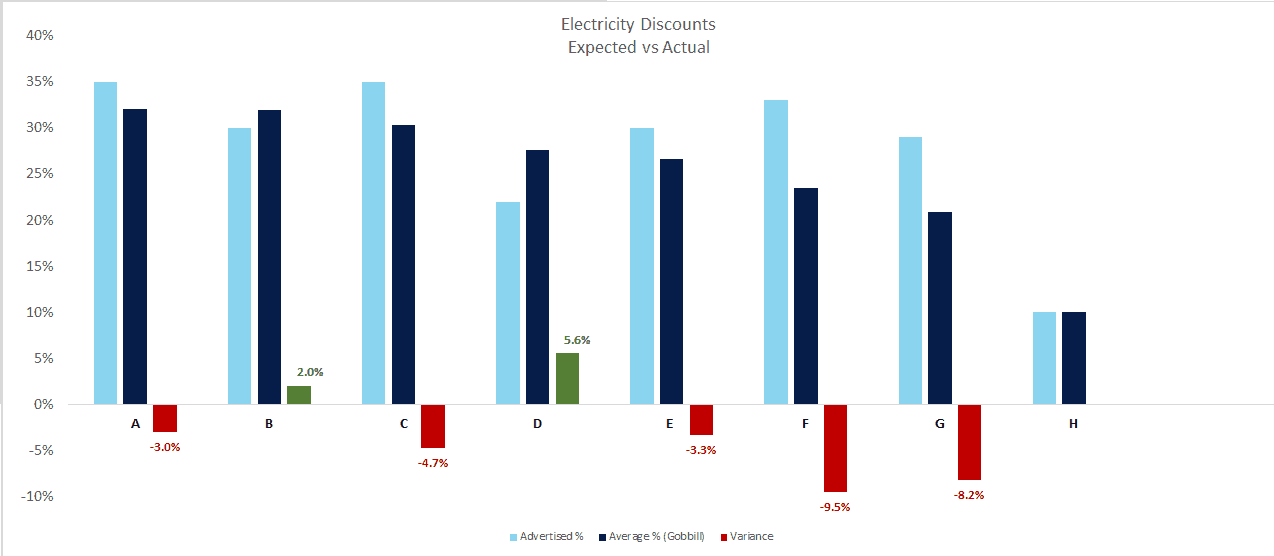

- Bill smoothing. To help you manage future bills, you can talk to your suppliers to arrange for ‘bill smoothing’. This is where you spread the cost of your bill over regular weekly, fortnightly or monthly payments. For example, you might pay a set amount of $100 a fortnight towards your electricity bill. This will help you budget and provide some helpful additional structure to help manage your larger bills.

- Tools and emergencies. You can use the MoneySmart budget planner to create your own budget with custom items. You can set up your budget and save it online or download and use the Excel budget spread sheet. Use any surplus you have each week to add to your emergency fund. This can give you a buffer to cover for any unexpected expenses.

- Review your budget regularly. It’s important to adjust your budget as things change. For example, if you find you can’t cover all your expenses, savings and spending, you may have to reduce your spending limit, or change your savings goal. As always, it is important to seek independent advice regarding your specific situation. This content should be regarded as general information.

For more ideas to help reduce spending, take a look at MoneySmarts advice on simple ways to save money.

Up to date as of 31 Jan 2021.