Direct debit can be a great way to organise your finances, but what are the risks? Make sure that you understand the pros and cons of direct debit before making a commitment to payments that may have hidden strings attached.

Don’t set and forget

Keep yourself informed of the direct debits associated with your bank account. Signing up for a trial can seem like a great way to access a free product, but if a biller only accepts direct debit ensure to cancel your subscription before the trial period has ended. Alternatively, if you are a customer who prefers the convenience of a ‘rolling’ policy (a policy that is automatically extended each year), review these payments regularly to confirm that you still require the services. Customers are often hit with charges for products they no longer use without notification from their provider.

Giving control to a third party can be risky

As direct debit payments allocate billing control to the biller and give your bank account details to a third party, it is vital that your service provider is a trustworthy organisation. Customers are not required to provide approval for payment, even if a bill is out of line with prior spending.

Monitor your bill payments

Using direct debits as a method of bill payment does not mean that customers can avoid monitoring bill amounts. To remove the potential of being overcharged, it is important to be vigilant about what is taken from your account. Monitor withdrawals from your biller and ensure that bill amounts are in line with your spending habits.

Cancelling can be a process

Depending on the biller and direct debit system, cancelling a direct debit can be a difficult process. When your direct debit is set up, ensure that you retain authority to end the debit unilaterally. Many banks are unwilling to stop direct debit at a customers request, meaning that a business may take several or more months of payments before the process is stopped. To cancel, customers will often be required to write a letter to the bank and merchant to stop the debits. Before setting up a direct debit read the Terms and Conditions and educate yourself on how to cancel in case you no longer require the service or product. Or alternatively, set up an alternative way to pay.

Paying bills with a credit card has benefits

Direct debit payments do not give users the opportunity to access rewards. For those looking to maximise their bill payment benefits, pay bills on a credit card where possible to gain cash and travel rewards. If your biller charges an inconvenience fee for credit card payments, this is the circumstance to look into a debit card or direct debit option. For billers that do not charge extra for the use of a credit card, do the research on what card will be most useful for which bill – do you want to use a card to increase points? Money flow? Choose what credit card gives you the best benefits for your preferences and go.

Careful of the extra fees

Utilising direct debit as a payment service can reduce the possibility of being charged late fees and get you pay-on-time discounts. However, if your bank account does not contain enough funds to cover the bill total, you may get charged a fee by both the financial institution and the biller. To manage this issue, it is important for users to either link direct debits to their primary bank account or set reminders to transfer funds before bill due dates.

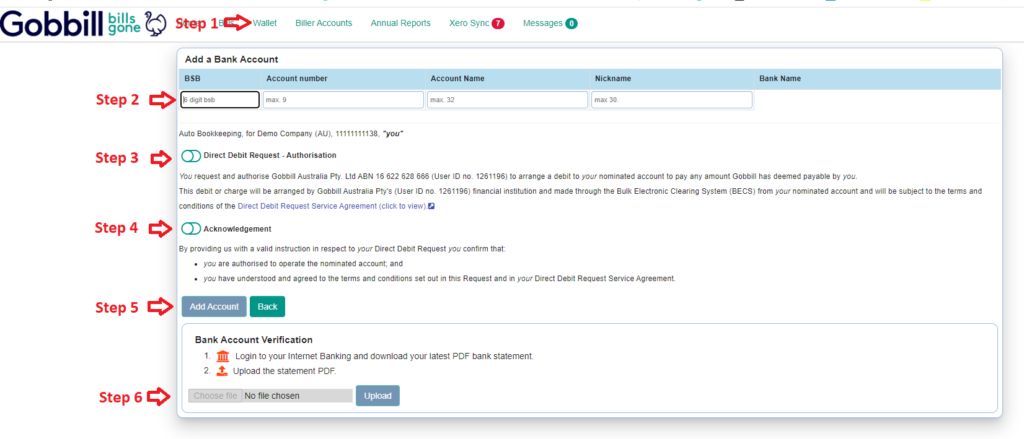

An alternative bill payment service like Gobbill can assist in avoiding the potential shortfalls associated with direct debit payments. The new online service issues payment reminders before a bill due date, gives users increased flexibility to pay bills using a credit or debit card, allows users to maintain control over bill payments and automates the bill payment process.

Contact Gobbill to find out more or Sign UP today for FREE